Germany's China Shock

How will Merz respond?

Two weeks before Chancellor Friedrich Merz makes his first trip to China, my Rhodium Group colleague Gregor Williams and I have taken a fresh look at the numbers behind Germany’s economic relationship with China. Click here for the full note “Germany’s China Shock Revisited”. It is a follow-up to our “Tipping Point” note of two years ago. I’ve broken out some of the key charts below.

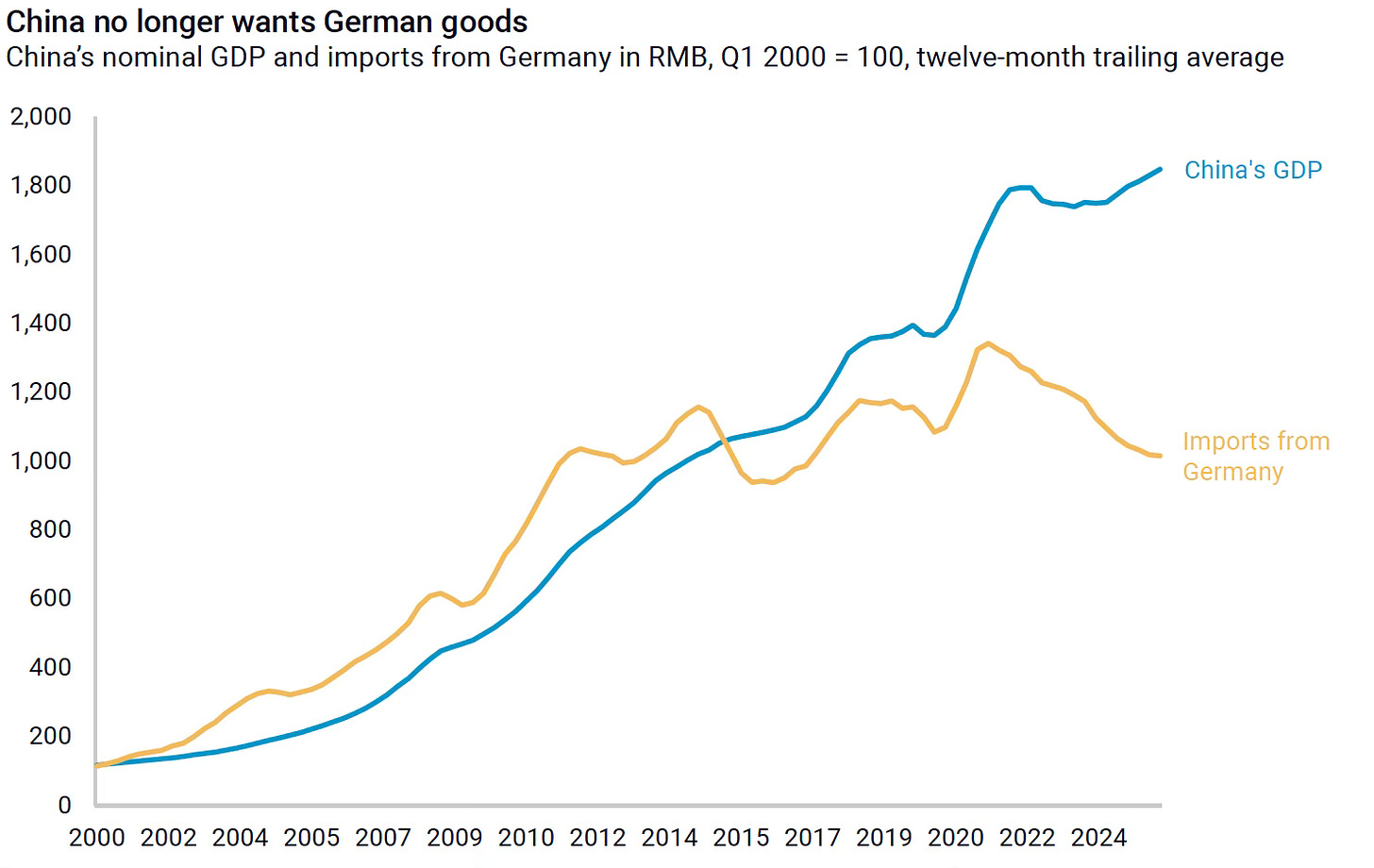

In the two decades leading up to the outbreak of the COVID-19 pandemic in 2020, German exports to China increased steadily, mirroring the expansion of the Chinese economy over the same period. Since 2020, however, Chinese growth rates and German exports have essentially decoupled due to rising Chinese competitiveness in core German manufacturing sectors, the localization of production in China by large German firms and import substitution policies from Beijing.

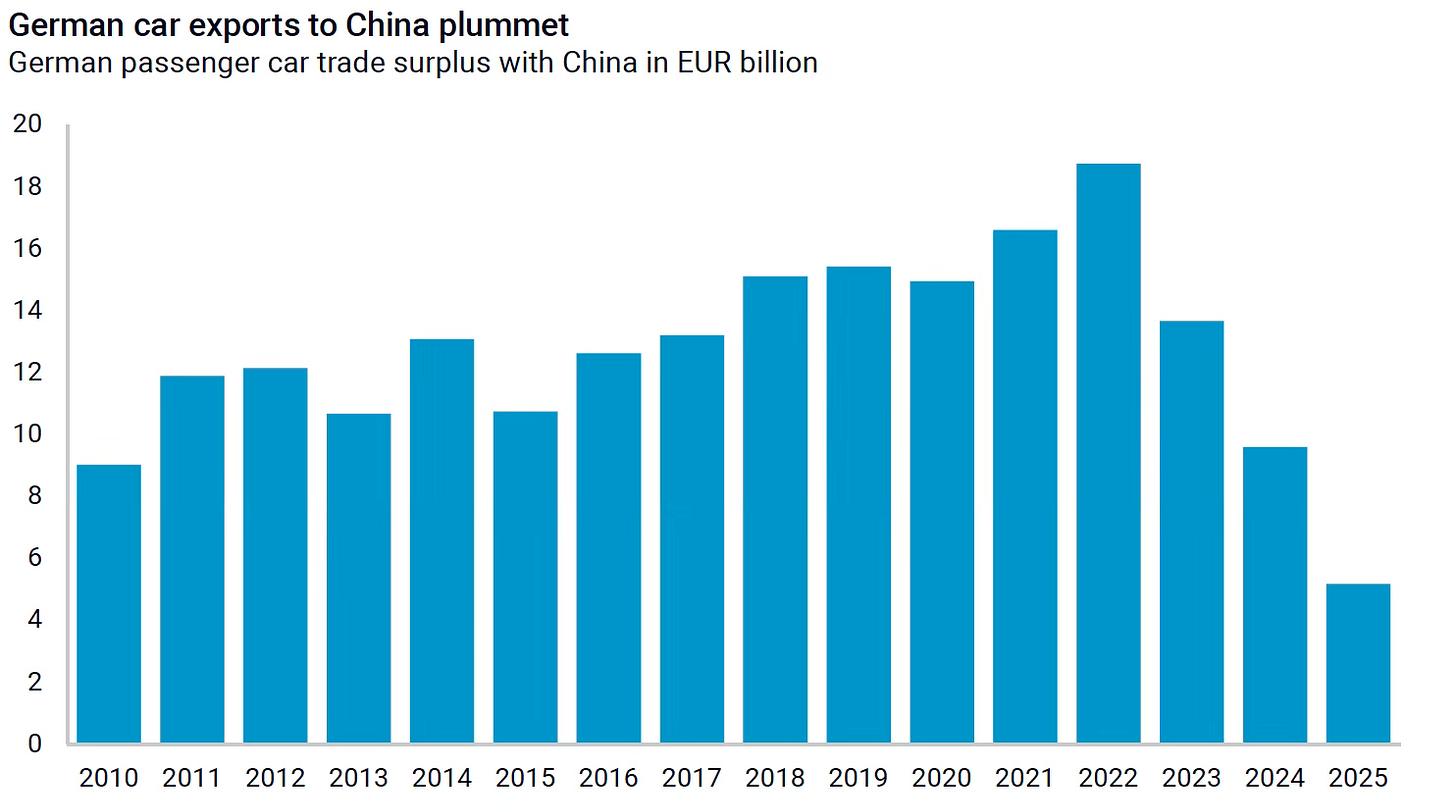

In 2025, German goods exports to China fell by 9.3% to €81.8 billion, their lowest level in a decade. This amounts to a decline of 23% compared to the peak reached in 2022. The drop has been led by a sharp decline in German car exports to China, which tumbled by 66% between 2022 and 2025, reaching their lowest level since 2009.

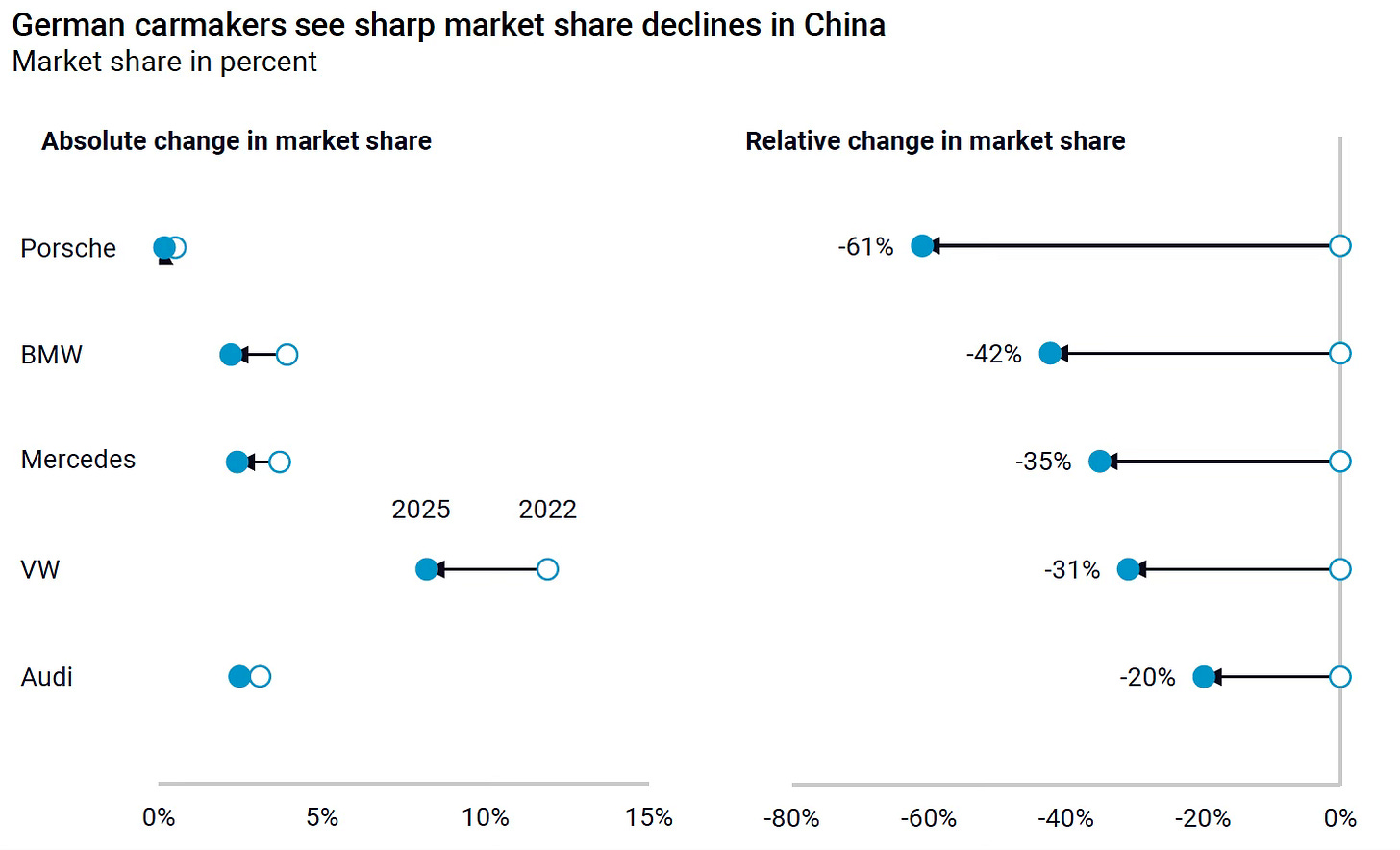

The market share of German carmakers in China collapsed by 33%, on average, between 2020 and 2025 and profitability has deteriorated even more markedly for some firms. Volkswagen’s profits from its Chinese joint ventures, for example, tumbled 60% in the Q1–Q3 2025 period, compared to the same period in 2022. China-based profits are also under acute pressure in other core German industries, such as chemicals.

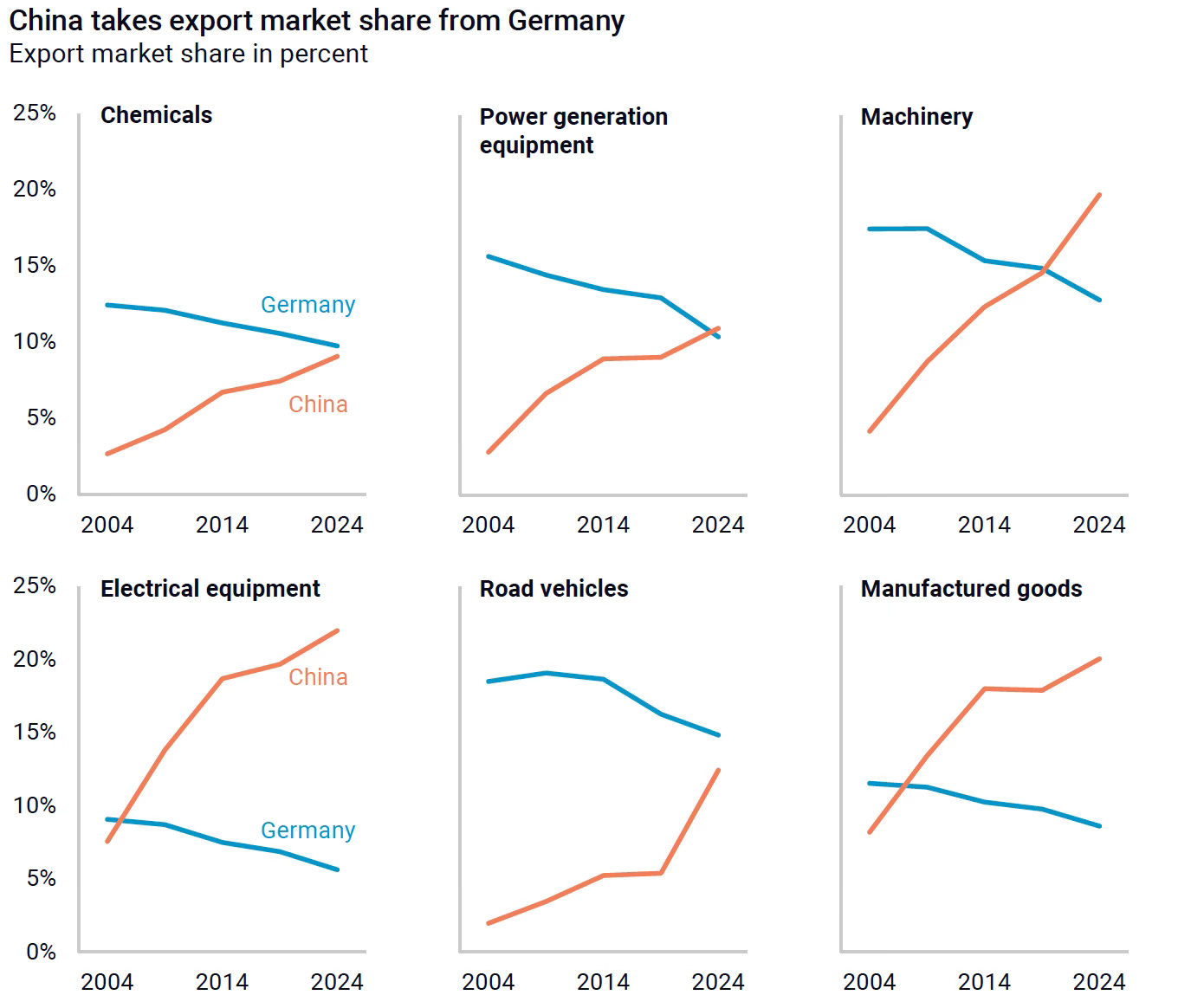

Chinese firms have seized market share from their German rivals at an accelerating pace in recent years, moving ahead in sectors like machinery and power generation equipment, and poised to overtake them in road vehicles and chemicals.

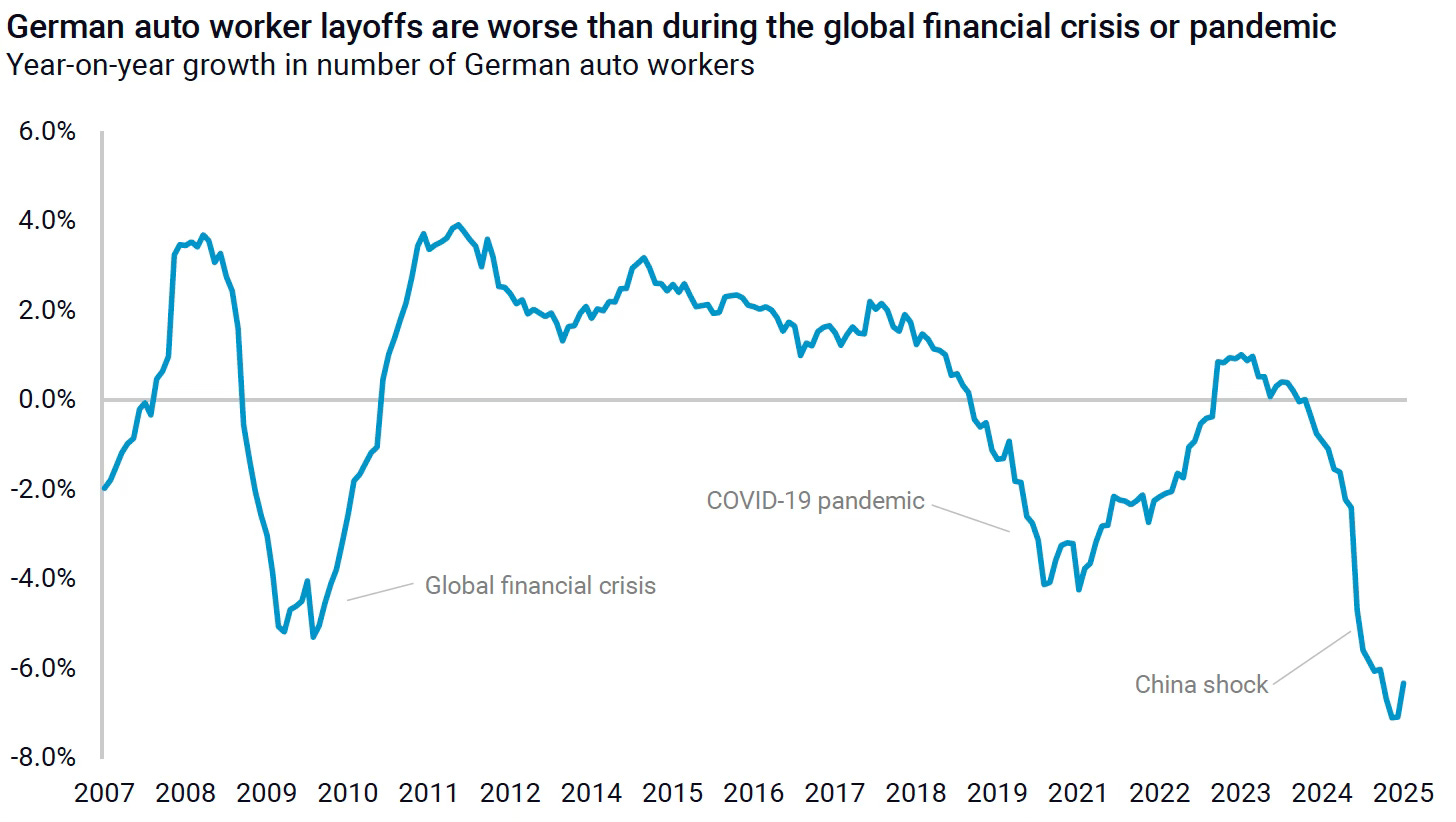

Layoffs in the German auto sector have been more pronounced than during the Covid-19 pandemic or the global financial crisis. Germany is losing roughly 10,000 manufacturing jobs per month. While competition from China is not the only reason, it has been is a significant driver.

Read the full note to find out how the German debate on China has shifted over the past two years, what we can expect from Merz’s upcoming trip, and what Germany can do to arrest the decline.

Germany can only blame itself for its poor policies that led to its demise. War against their energy and metals supplier Russia has nothing to do with China. Lack of globally competitive innovation has nothing to do with China. Using export controls to prevent China from accessing CNC technologies, etc., at the command of the US created their own economic detriment, like ASML/Japan et al. The West complains, but it's their own actions that doom its future. These irritating trade restrictions, tariffs, etc. won't stop China from innovating, won't diminish China's infrastructure advantages, and won't displace the labor China has.

I don’t think it is the ideological constraints of ordoliberalism so much as the idea that, for example, German car companies need to have access to the Chinese market to stay competitive. Heads China wins, tails Germany loses.